Five banks of the BRICS Interbank Cooperation Mechanism (ICM) have agreed to establish local currency credit lines and develop cooperation on credit ratings in the run-up to the forthcoming BRICS summit in China, according to one of the signatory banks on Saturday.

"The agreement and memorandum were executed by the CEOs of Exim Bank of India, Brazil's Banco Nacional de Desenvolvimento Economico e Social, China Development Bank, Development Bank of Southern Africa and Vnesheconombank," Russian development bank Vnesheconombank said in a statement.

"The banks will establish a framework mechanism to extend credit lines in local currencies to the BRICS (Brazil, Russia, India, China, South Africa) ICM members and the BRICS companies against guarantees of the signatory banks," it said.

The agreement on credit ratings allows the ICM members to share information about internal credit ratings assigned to clients, as well as rating assessment and assignment methodologies, the Russian bank said.

"Information will be provided at request and on a confidential basis," it added.

The use of local currencies will help promote mutually beneficial economic cooperation, mitigate currency risks, increase trade, and facilitate companies in accessing the BRICS markets," Vnesheconombank board member Nikolay Tsekhomsky said in the statement.

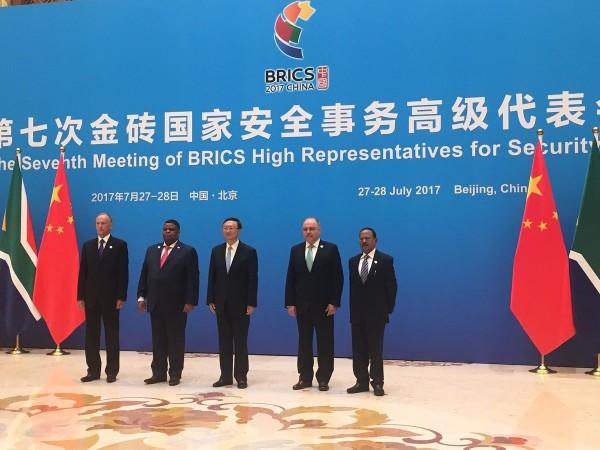

The meeting of bank representatives took place here on Friday ahead of the BRICS leaders summit scheduled for September 3-5 at Xiamen in China.

Also on Friday, BRICS New Development Bank President K.V. Kamath said in Shanghai that the NDB aims to lend around $4 billion next year and also plans to start lending to private sector projects.

He said the BRICS bank lent $1.5 billion in 2016 and will make $2.5 billion in loans this year, while it has invested in 11 projects so far.

"We will be only lending on a sovereign basis, maybe for little bit more time, till possibly late this year," he said.

At the meeting with BRICS corporate leaders, Kamath said he hoped they would be able to take loans in local currencies as part of the bank's initial wish to "break away from the tyranny of hard currencies".