Now is the time to fulfil that lifelong wish to see the world's largest coral reef system. Uber has partnered with Citizens of the Great Barrier Reef and Queensland Tourism to bring a limited, exclusive experience to the public. For the next few weeks, people will be able to request an Uber to the Great Barrier Reef.

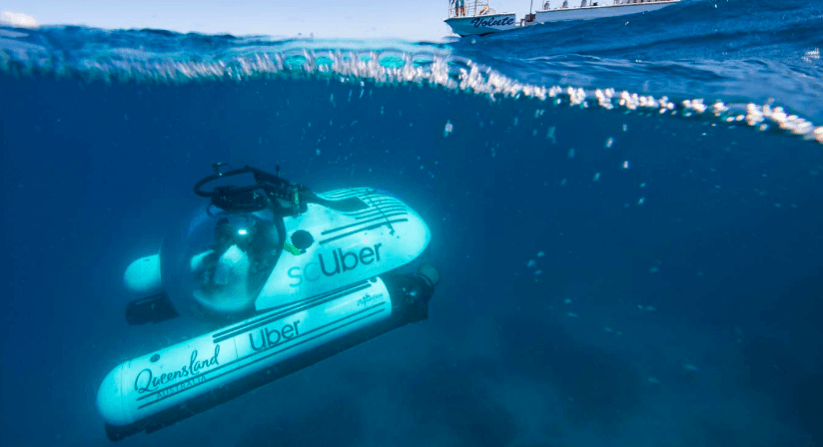

You heard that right and it is promising to be a once-in-a-lifetime experience that costs 3,000 AUD (approx. Rs. 1.4 lakhs). It allows two people to be picked up from their location in a scUber car, take a helicopter ride from Gladstone to Heron Island, or from Cairns or Port Douglas to Agincourt Reef, and ride for an hour in a scUber submarine to watch the beauty of the world's largest coral reef system.

From a car to a chopper and then into a submarine. Uber has found ways to justify that cost.

People in Gladstone, Cairns, Port Douglas and Palm Cove can request a scUber experience using the Uber app on the following dates:

- Gladstone – May 27, 28, 30 and 31; June 2 and 3

- Port Douglas, Palm Cove and Cairns – June 9, 11, 12, 14, 15, 17 and 18

There is also a lucky draw, giving people a chance for a "once-in-a-lifetime trip" to experience scUber in Australia. The prize package includes return airfares and transfers, 5 nights accommodation, a ride in scUber at Agincourt Reef (a world-heritage listed Daintree Rainforest Tour), and $250 AUD Uber credit for use in the Uber and Uber Eats app.

The Great Barrier Reef was declared a World Heritage Area in 1981, and it is the first coral reef system to be recognised by UNESCO. Despite being well-managed and heavily protected, Australia's oceans have suffered from environmental damage. Rising carbon emissions and pollution have caused the reef to shrink over the years.

Uber will be donating $1,00,000 (approx. Rs. 70 lakh) as per their partnership with Citizens of the Great Barrier Reef for its conservation. Furthermore, Uber will donate additional money equivalent to the value of each scUber ride.

Uber went public earlier this month but was not able to live up to the hype. Its valuation was pumped higher with each round of funding. It has incurred heavy losses and is still trading at 8% below the IPO price.