The rise of cryptocurrencies and blockchain technology has given the international community within Africa the much-needed economic mobility and central flexibility it required to regulate transactions and procedures across different markets and industries, especially the financial sector.

The African financial wing has been a troubled institution which suffers from hyperinflation, corruption, and intermittent military coups. Zimbabwe has been a financially devastated nation since its racial diversity erupted in bloodshed. The internal conflict between the major African population and the minority faction of Europeans ensured the country was tied up in 16 years of warfare that resulted in international isolation, as well as a change in name from 'Rhodesia' to 'Zimbabwe'.

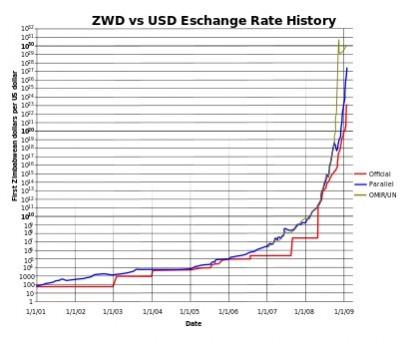

Ultimately, the lack of trade and production resulted in a phenomenon known as 'hyper-inflation' (India's inflation rate stands at 8 percent and Zimbabwe rules the roost at 10,000,000,000 percent).

A failed financial structure is also an ongoing scenario for 90 percent of the remaining countries within the continent. But the inception of blockchain technology and cryptocurrencies has provided solace to the crumbling surface beneath the continent's feet.

Blockchain will be the knight in shining armor

After the United States got involved through the United Nations, Zimbabwe saw a reduction in inflation woes as the superpower declared the phasing out of the redundant local currency and a proposal to completely switch over to the American dollar. In the wake of this, to increase trade and market growth, Zimbabwe got its first digital trading platform 'Golix' in 2014, right after the market cap for cryptocurrency saw a sudden boom that year. In 2018, Zimbabwe launched an alternative trading platform called 'Styx24' which claimed to be more reliable, transparent and efficient than 'Golix'. The trade market in Zimbabwe sees the lowest influx of the US dollar, and hence to curb this shortage, the citizens and traders of the country are turning to newer platforms and cryptocurrencies to trade in.

The war-plagued nation of Sierra Leone had seen president Siaka Stevens ousted in a bloody military coup, within hours of taking office, by General Lansana in 1967. That was the last time the nation enjoyed the privilege of democracy for years. And when we fast-forward to 2018, the presidential elections for Sierra Leone took place using the blockchain platform to verify the authenticity of the votes cast. The nation went from a war-torn and relief-dependent state to a structure using blockchain technology to regulate governmental organizations. The voting platform was provided by 'Agora'. It became the first country in the world to incorporate the ledger-based technology into the central election process.

Another problem which affects the continent's ambition to move forward is the 'darkness' that engulfs it. And the darkness, in reference here, is the lack of education and inherent backwardness. A majority of the population (between 51-68 percent) have lived the whole, or a majority, of their lives without basic amenities such as power, water, and clothing! Large clans or tribes exist in almost all the countries and they are primarily nomadic. So, the obvious takeaway from these statistics is that the people are unaware because they're still hunting with a bow and arrow!

And the collapse of the partially existent market, because of a lack of industry and trade, has led to the centralization of the trading market with the help of the US and other World Organizations.

"The way Africa's financial systems are set up today, any instance of cross-border money transfer has to use the US dollar as a bridge, which means it has to go through the central bank," said Michael Kimani, Bitcoin market analyst and a founding member at Bloc Chain East Africa Ltd., a company which is leveraging a common ground for East Africans and the concept of blockchain technology.

"The challenge is how to process payments because every country in Africa has a different regime on payments and moving money," Kimani further added. This disparity in monetary trade and absence of protective charters has scared away potential investors and developers from entering the African scene.

Cryptocurrency solves this crisis by providing a decentralized, and verifiable, the ledger for inter-continental transactions."With cryptocurrency, it is now possible for an African company to set up a payment corridor between say East Africa and China, and completely bypass the US dollar," Kimani said in an interview with AFKInsider. "This saves time, money and increases the ease of doing business."

Even with these altering strides, blockchain technology is still a pipe-dream for some of the other warring nations and failed states.

Africa would benefit the most from blockchain, especially in exceptional cases like that of Somalia, which can completely do away with their tainted currency. The country has only 1 note in circulation, which is the 1,000 shilling note. The value of a paper currency in the country went sour since the fall of its government in 1991. Cryptocurrency will provide a more stable and secure ledger which will not be affected due to illegal printing.

Michael Kimani will be present at the upcoming World Blockchain Summit in Nairobi on March 22 and 23 to divulge more information on the state of affairs within the continent and why they immediately need blockchain and cryptocurrency solutions.

Where does blockchain stand currently in Africa?

In 2018, as blockchain stands adequately at a staggering worldwide cap of $1.3 trillion and an expectation to touch the $9 trillion mark by 2025, we cannot ignore the blockchain innovations and solutions being developed, and simultaneously implemented across the African continent.

UN Secretary General Ban-Ki Moon said that 30 percent of the UN relief aid doesn't reach its final destination. But the truth is that a staggering 70 percent is lost due to corruption. An MBA student from South Africa developed a solution to curb this. Money could be deposited into a pooled account of a bank, and the bank, in turn, can issue digital tokens of the same value. These tokens can only be accessed by the beneficiaries through an encrypted key that will unlock the token.

The registration of 17 million users in Kenya for Safaricom and Vodacom's M-Pesa scheme, which operates as an encrypted monetary exchange platform within your mobile phone, shows the eagerness of the civilians to switch to more secure banking practices. The National Bank of Kenya has begun warming up to the idea of implementing blockchain for its operations as well.

Also, South Africa's Central bank has announced that it will test run JP Morgan's Quorum blockchain technology for interbank clearing and settlements.

So, why World Blockchain Summit?

Blockchain has the power to completely transform the African landscape by providing a structural stability to the nation, as well as liberate them from internal flaws.

World Blockchain Summit aims to connect innovators and developers of blockchain technology to governments and organizations which is seeking to effect changes within the continent.

Colonisation and enslavement have resulted in Africa lagging behind, in development, by a hundred years in comparison to the other nations of the world. So, blockchain and cryptocurrency can hasten the process of bringing the entire continent up to speed with the rest of the World!