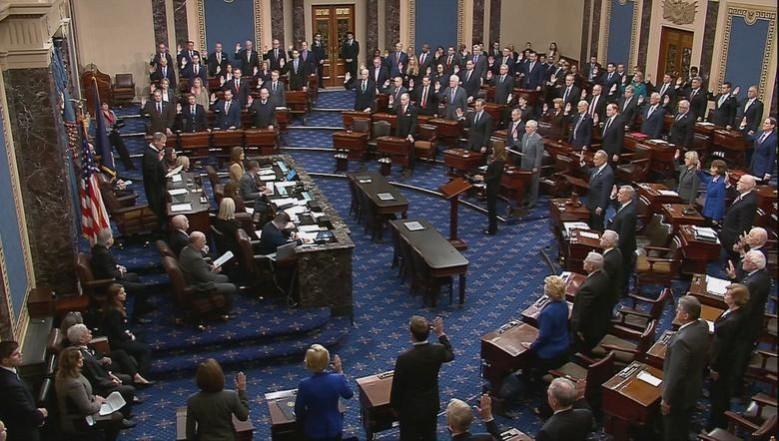

As the tension between the world's two largest economies increases, the US Senate has approved legislation on Wednesday that may bar Chinese companies including Alibaba Group Holding Ltd and Baidu Inc from listing on US stock exchanges. The bill that was introduced by Republican Senator John Kennedy, and a Democrat Chris Van Hollen from Maryland was overwhelmingly passed in the upper chamber of the United States Congress. The bill would mean the companies would require to certify that they are not under the control of any foreign companies.

If a company cannot demonstrate that it is not under such control or the Public Company Accounting Oversight Board or PCAOB is unable to audit the company for three successive years to conclude that it is not under the control of a foreign government, the securities of the company would be banned from the exchanges.

Future listing to be affected

In past the US legislators have raised alarms over billions of dollars being injected into some of China's largest corporations. Majority of being coming from pension funds and college endowments in search of smart investment returns. Interestingly, the more stringent US oversight may affect the listing plans of major private Chinese corporations from Jack Ma's Ant Financial to SoftBank-backed ByteDance Ltd that is due in the near future. As per a report in Bloomberg, in case of higher scrutiny many Chinese companies would list in Hong Kong. In fact ever since this development came into public last year many Chinese corporations have already listed in Hong Kong.

James Hull, a Beijing-based analyst, and portfolio manager with Hullx said, "All Chinese US-listed entities are potentially impacted over the coming years. Increased disclosure may hurt some smaller companies, but there have been risking disclosures around PCAOB for a while now, so it shouldn't be a shock to anyone."

Will Modi government take the American way?

Notably, last month Modi government, changed the existing rule in its Foreign Direct Investment (FDI) policies to thwart "opportunistic takeovers or acquisition" of Indian companies due to the COVID-19 pandemic. The updated rules are targeted at non-resident companies that are from neighboring countries that share a land border with India including China and other nations such as Nepal, Bhutan, and Myanmar. It is unlikely that India will take further steps to check Chinese presence in Indian markets given the huge amount of investments made.