Shares of Bharti Airtel — India's largest telecom service operator by subscriber base — were down 1.52 percent on the Bombay Stock Exchange (BSE) at around 11.45 am on Monday even as brokerage Motilal Oswal Securities Ltd. (MOSL) has an upgrade on the stock. The company had recently acquired Telenor's India operations in seven circles for an undisclosed sum.

Read: Bharti Airtel buys Telenor's India ops; Fitch retains negative outlook for telecom

MOSL said there are several positives for Bharti Airtel in the fiercely-competitive Indian telecom market sector where the second and third players are Vodafone India and Idea Cellular (both are in talks for a possible merger).

First, the acquisition will give Bharti Airtel access to 5-7MHz spectrum in the much-sought-after 1800MHz spectrum in seven circles comprising Maharashtra, Gujarat, Andhra Pradesh (AP), Uttar Pradesh (UP) East, Uttar Pradesh West, Bihar and Assam.

Bharti currently holds about 5MHz liberalised spectrum in each of these circles, except in AP, where it holds 10MHz spectrum. "A 5MHz block is fairly good to offer seamless 4G network," MOSL said in its telecom sector update.

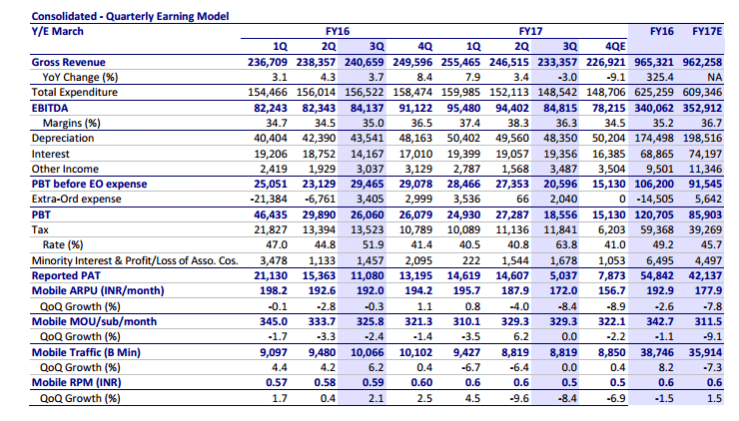

Secondly, the acquisition will lift Bharti Airtel's revenues and operating profit (EBITDA).

"Telenor earns revenue of ~Rs 11b (Rs 1,100 crore) and EBITDA of ~Rs 1b (Rs 1,000 crore) per quarter. Assuming its revenue base dilutes by 35-40%, given the high share of second sim cards, it should still manage annual revenue of Rs 25b-30b on stable state basis. Telenor's EBITDA could improve to Rs 6b-7b, assuming 25-27 percent margin compared to Bharti's 38 percent India wireless margin," the brokerage said.

Bharti Airtel had a subscriber base of 265.85 million in India at the end of the third quarter (Q3) ended December 31, 2016. TheTelenor acquisition will add about 44 million subscribers.

For Q3, Bharti Airtel's net profit dropped 54.6 percent to Rs 504 crore on a year-on-year basis, while revenues fell 5 percent to Rs 23,336 crore. India revenues grew 1.8 percent to Rs 18,013 crore.

Explaining its decision to upgrade the stock price of Bharti Airtel to 410 from the current levels, the brokerage also cited the company's move amid Reliance Jio's aggressive plans.

"We believe Bharti's strategy to remain ahead of the curve in data-rich spectrum investments should bolster its defense against RJio and hold it in good stead. While the incremental spectrum may not be presently required, given the large scale data traffic on RJio's network, holding high quantum of spectrum would allow Bharti to compete with RJio in a fixed-cost-driven market. We reiterate our Buy recommendation," MOSL said.

Vodafone shares are not listed on Indian stock exchanges, while Aditya Birla Group company Idea Cellular was trading 1.55 percent lower at Rs 117 at around 12.20 pm on Monday.