The FASTag mandate created a panic among Indian drivers who had to get their vehicles stickers to cross tollbooths before the set deadline. But seeing how the process was confusing to many, fraudsters looked at it as an opportunity to dupe unsuspecting users. As a result, users could lose all their money as frauds pose as official executives to help you with the registration process.

Everyone must be vigilant of FASTag activation fraud, which has already claimed its first victim in Bengaluru recently. According to reports, a Bengaluru resident lost Rs 50,000 to fraudsters pretending to be Axis Bank customer support executives trying to help the man with FASTag activation.

"The caller sent me a link through SMS, which said 'Axis Bank-FASTag form.' As asked, I provided them with details to get my FASTag wallet activated. In the form, I gave various details, including my UPI PIN. I thought that the application itself was a point of recharge. Therefore, I typed the PIN and submitted it," the victim was quoted as saying.

Using the procured information, the frauds initiated a fund transfer. The victim was informed in advance that he would receive an OTP to avoid suspicion. Later when the victim got the OTP, he sent to another number and the fraudsters successfully pulled off a scam.

How to identify FASTag fraud?

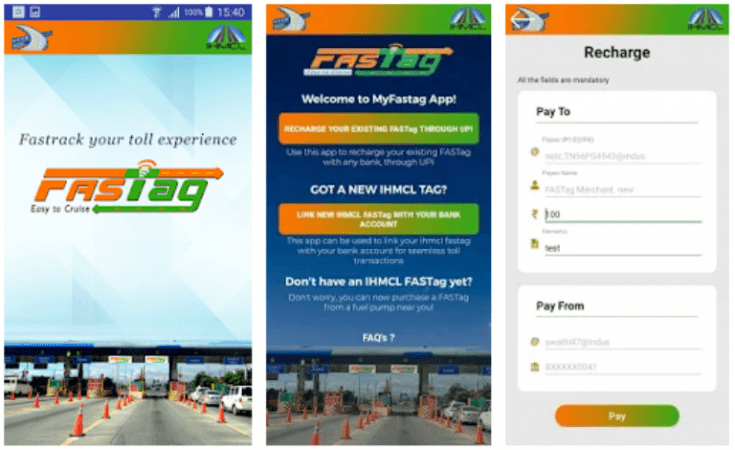

FASTag activation has been simplified for users to avoid incidents such as this. Users could either activate FASTag using MyFastag app or visit the nearest bank. Under no circumstances, FASTag can be activated over the phone by talking to any representative.

- If you get a call offering help with FASTag activation over the phone, do not engage

- If any person seeks your UPI details, banking information over the phone, do not entertain the request

- Never share OTP you receive on your phone with anyone. No official, even bank representatives, can ask you for your OTP

FASTag is linked to your bank accounts and payments are directly deducted from the linked account. Users could create NHAI prepaid wallet, recharge it and link it to FASTag for payments. Alternatively, users can recharge FASTag using UPI via MyFastag app.

How to buy and activate FASTag?

As mentioned earlier, FASTag activation can only be done by visiting the bank or via MyFastag app. Users can also buy FASTag at select petrol pumps or point-of-sales set up by banks or NHAI near toll booths. Users can order for a FASTag online via Amazon, PayTM and Airtel Thanks app.

If you purchase the FASTag online, the activation must be done via MyFastag app. You will need your vehicle details, FASTag number and then choose a payment method. If a wallet is linked to the FASTag account, users must maintain minimum toll fee balance at all times while passing through the electronic toll gate.

It is important to understand that FASTag activations CANNOT BE DONE OVER THE PHONE.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)