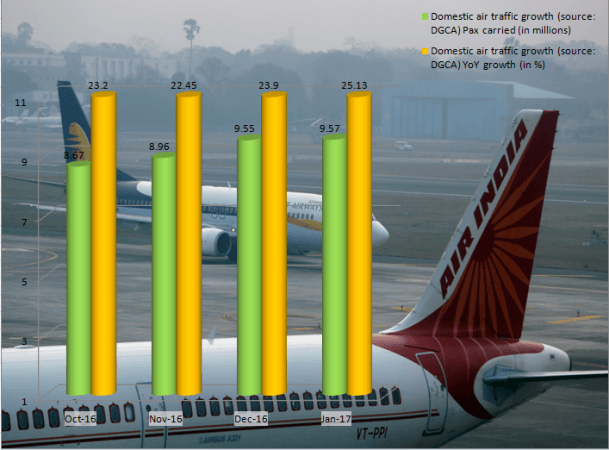

Aviation stocks are likely to buzz next week, as the civil aviation regulator — Directorate General of Civil Aviation, or DGCA — is scheduled to release domestic air traffic data for February. The month saw the 12th domestic airline, Zoom Air, launching its commercial operations.

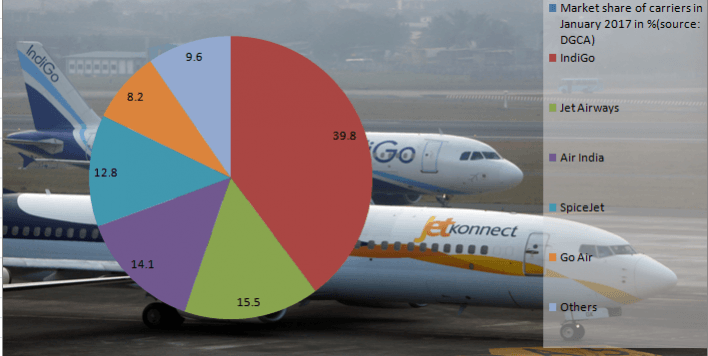

In January 2017, the market share of the top four carriers did not change much, with budget carrier IndiGo maintaining its lead by a huge margin.

On Friday, shares of IndiGo-owner Interglobe Aviation closed 3.42 percent higher at Rs 922 on news that it plans to convert more Airbus A320neos to A321neos.

Jet Airways ended 2.97 percent higher at Rs 477, while SpiceJet closed almost flat at Rs 84.

Other carriers, including state-owned Air India are not listed on Indian stock exchanges. Go Air and AirAsia India are low-cost carriers, while Vistara, a joint venture between the Tatas and Singapore Airlines, is a full-service airline.

In related news, Qatar Airways has evinced interest in entering the Indian civil aviation market. If the carrier makes a formal proposal and gets clearance, it will be first success for India ever since it relaxed FDI norms in civil aviation last June.

"We will have a 100% owned domestic carrier in India that will belong to both QR (Qatar Airways) and our state investment arm as India has now allowed foreign investment in domestic carriers within India. We will soon be making an application to that effect," Qatar Airways CEO Akbar Al Baker said at the ITB Berlin travel show a few days ago.

The Doha-headquartered airlines can have a maximum 49 percent stake, while the balance is likely to be held the Qatar government's investment arm, the Qatar Investment Authority (QIA).

India initiated a slew of FDI reforms last June spanning defence, civil aviation and other sectors.

The specific provisions of civil avaition read: "As per the present FDI policy, foreign investment up to 49% is allowed under automatic route in Scheduled Air Transport Service/ Domestic Scheduled Passenger Airline and regional Air Transport Service.

"It has now been decided to raise this limit to 100%, with FDI up to 49% permitted under automatic route and FDI beyond 49% through Government approval. For NRIs, 100% FDI will continue to be allowed under automatic route.

"However, foreign airlines would continue to be allowed to invest in capital of Indian companies operating scheduled and non-scheduled air-transport services up to the limit of 49% of their paid up capital and subject to the laid down conditions in the existing policy."

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)