![[Representational Image] Apple pips Samsung to become best smartphone seller in Q4 (2017) with Xiaomi breathing down its neck. In this picture taken on May 9, 2017, a woman using a smartphone walks past the logos of five smartphone companies outside a smartphone shop in Shenzhen. smartphones, global smartphone market share](https://data1.ibtimes.co.in/en/full/654902/smartphones.jpg?h=450&l=50&t=40)

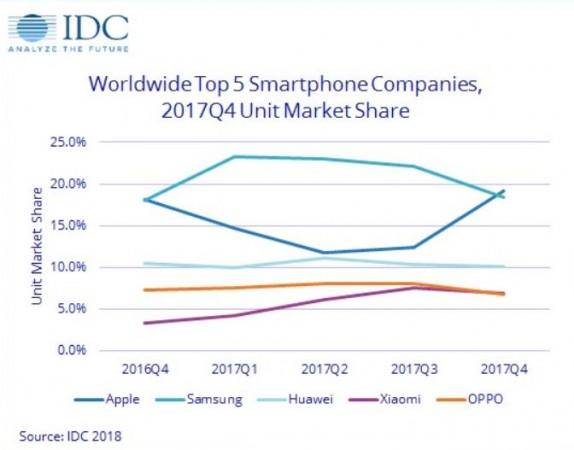

Cupertino-based Apple has overtaken its arch-rival Samsung as the global smartphone market leader, but only in the recently concluded fourth quarter, 2017.

Thanks to total domination (by Galaxy S8 series) in the first three quarters, Samsung managed to keep the top slot in terms of shipments for the whole year, International Data Corporation (IDC) reported citing Worldwide Quarterly Mobile Phone Tracker.

That being said, the overall market scenario in 2017 has been quite dull, For the full year, the worldwide smartphone market saw a total of 1.472 billion units shipped, with a decline of less than 1 percent compared to the 1.473 billion units shipped in 2016.

Furthermore, mobile vendors shipped a total of 403.5 million units during the fourth quarter of 2017 (4Q17), that's 6.3 percent drop when compared to the 430.7 million units shipped in the same period last year.

Slow growth in top markets — China and the US — is said to be the primary reason, as customers, despite having a plethora of flagship phones with newest display standard (18:9 aspect), OLED screen, powerful processor and more, showed no eagerness to make the purchase in the Christmas holiday season.

"In the presence of ultra-high-end flagships, the still high-priced flagships from the previous generation seemed far more palatable to consumers in 2017," Jitesh Ubrani, senior research analyst with IDC's Worldwide Mobile Device Trackers, said in a statement.

"Many high-profile companies offered their widest product portfolio ever in hopes of capturing a greater audience. Meanwhile, brands outside the top 5 struggled to maintain momentum as value brands such as Honor, Vivo, Xiaomi, and OPPO offered incredible competition at the low end, and brands like Apple, Samsung, and Huawei maintained their stronghold on the high end," Ubrani added.

Apple shipped 77.3 million iPhones in the fourth quarter, 1.3 percent less than the previous year in the same period. However, volumes were still enough to push Apple past Samsung and back into the first place in the smartphone market, largely because of iPhone 8, 8 Plus, and iPhone X. Samsung shipped 74.1 million smartphones compared to 77.5 million in the Q4 2016, IDC reported.

Even the emerging players Huawei (-9.7 percent) and Oppo (-13.2 percent) witnessed negative growth, but on the brighter side, Xiaomi had the most successful quarter with a staggering 96.9 percent growth.

Top 5 Smartphone companies, shipments, market share, and Year-Over-Year Growth, Q4 2017 Preliminary Data (shipments in millions)

| Company | 4Q17 Shipment Volumes | 4Q17 Market Share | 4Q16 Shipment Volumes | 4Q16 Market Share | 4Q17/4Q16 Change |

| 1. Apple | 77.3 | 19.2% | 78.3 | 18.2% | -1.3% |

| 2. Samsung | 74.1 | 18.4% | 77.5 | 18.0% | -4.4% |

| 3. Huawei | 41.0 | 10.2% | 45.4 | 10.5% | -9.7% |

| 4. Xiaomi | 28.1 | 7.0% | 14.3 | 3.3% | 96.9% |

| 5. OPPO | 27.4 | 6.8% | 31.6 | 7.3% | -13.2% |

| Others | 151.3 | 38.6% | 183.7 | 42.7% | -17.6% |

| Total | 403.5 | 100.0% | 430.7 | 100.0% | -6.3% |

| Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 1, 2017 | |||||

In terms of whole year, Samsung holds the top slot with 21.6 percent, while Apple and Huawei settled for second and the third position with 14.7 percent and 10.4 percent, respectively.

Oppo is placed fourth with 7.6 percent market share. On the other hand, Xiaomi, which was nowhere close to the top slots in 2016, has jumped to fifth with 6.3 percent global market share.

Top 5 smartphone companies, shipments, market share, and YoY growth, Calendar Year 2017 Preliminary Data (shipments in millions)

| Company | 2017 Shipment Volumes | 2017 Market Share | 2016 Shipment Volumes | 2016 Market Share | Year-Over-Year Change |

| 1. Samsung | 317.3 | 21.6% | 311.4 | 21.1% | 1.9% |

| 2. Apple | 215.8 | 14.7% | 215.4 | 14.6% | 0.2% |

| 3. Huawei | 153.1 | 10.4% | 139.3 | 9.5% | 9.9% |

| 4. OPPO | 111.8 | 7.6% | 99.8 | 6.8% | 12.0% |

| 5. Xiaomi | 92.4 | 6.3% | 53.0 | 3.6% | 74.5% |

| Others | 577.7 | 39.5% | 654.5 | 44.4% | -11.7% |

| Total | 1472.4 | 100.0% | 1473.4 | 100.0% | -0.1% |

| Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 1, 2017 | |||||

Xiaomi's astronomical growth is attributed to the company shifting its focus outside China, particularly in India, Russia and entering in Europe (Portugal, Spain, among others) and also improving the Mi and Redmi series devices' availability in traditional brick-and-mortar stores via Mi Homes and Mi Preferred Partnership with big retail chains in India.

Stay tuned. Follow us @IBTimesIN_Tech on Twitter for latest updates on smartphones.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)