The market is likely to witness a major rally before the next Samvat, says V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Once there is some clarity on the outcome of the next general elections due before May 2024, markets will rally, he said.

The resilient Indian economy and good corporate earnings will attract big investment into the market. If the US bond yields continue to decline FIIs will also become buyers in the market.

The bull case scenario is a flood of institutional money -- both domestic and foreign -- and a stable government triggering a big rally in the market taking the Nifty beyond 23,000 by next Samvat, he said.

Large-caps across sectors will lead the rally. The likely outperformers are financials, capital goods and automobiles. In IT mid-caps will continue outperforming large-caps, he added.

Vaishali Parekh, Vice President - Technical Research, Prabhudas Lilladher said Nifty once again witnessed a narrow range bound session resisting near the 19,450 zone during the intraday session with active participation among the broader markets.

With 19,200 - 19,250 acting as the support zone, a decisive breach above the hurdle of 19,500 - 19,550 zone shall trigger a fresh upward move with bias improving further. The support for the day is seen at 19,350, while the resistance is seen at 19,600.

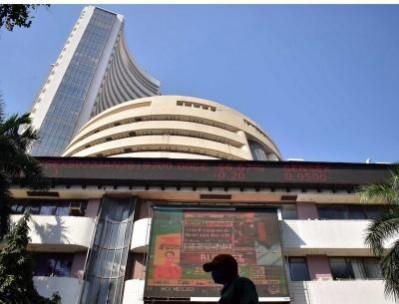

BSE Sensex is down 23 points at 64,951 points on Thursday. M&M is up more than 2 per cent.

(With inputs from IANS)