Giant e-commerce retailer Amazon India's gross sales volume surged 67 percent in the September quarter compared to a year earlier driven by robust demand from people shopping online and festive season in the country.

Amazon India's gross sales by value soared 72 percent during the quarter. The company also claimed that it grew much faster than its biggest home-grown rival Flipkart in the April-September period saying that its gross sales surged 66 percent in six months.

According to Amazon, it consistently marched ahead of Flipkart on areas such as app downloads, desktop visits and mobile website visits. Also, Amazon's Prime subscription service has also proved to be a huge contributor to its growth in top-tier cities in India.

Last week, Amazon's wholesale unit in India also reported a solid increase in turnover of nearly 2,700 times for the fiscal year 2016-17, emerging as a major contributor to the global retail giant's overall operations in the country.

Amazon has also said that it has more than doubled its business in India in FY17, with over 105 percent growth in revenues.

But Indians prefer Flipkart more

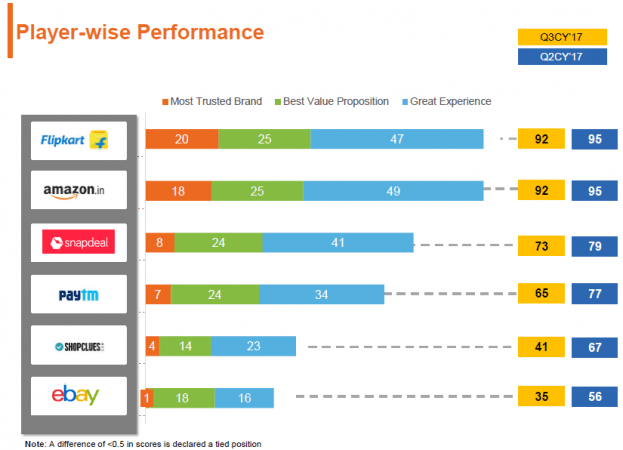

However, despite Amazon posting a surge in gross sales, according to a report by Redseer Consulting that tracks India e-commerce sector, Flipkart nudged slightly ahead of Amazon India on the E=tailing Leadership Index (ELI) in the Q3 2017.

ELI is one of the most accurate and comprehensive assessments of e-tailer performance in the Indian customer's mind.

The e-commerce advisory firm polled about 7,500 respondents across 30 cities between July and September period and found that Indian shoppers trust Flipkart as a brand more than Amazon.

The survey rates the companies on three parameters – most trusted brand, best value and great buying experience.

While in metro cities Flipkart is only slightly ahead of Amazon in being the most trusted brand, it also takes a bigger lead in non-metros.

"A clear trend from our study indicates that Flipkart enjoys greater recall with new online shoppers, who are coming primarily from tier 2 towns and lower income groups," said Kanishka Mohan, senior consultant at Redseer.