Reliance Jio's unparalleled contributions to the Indian telecom industry from a consumer perspective have made mobile internet a necessity than a luxury. By offering 4G LTE, VoLTE voice calls and other services for free for several months and following it up with competitive tariffs, Reliance made another strategic step to connect the people of India with the launch of JioPhone.

Reliance Jio has incumbents such as Airtel, Vodafone, Idea and BSNL worried with its unpredictable moves. Airtel recorded smallest profit in Q1 since December 2012 as a result of the price war initiated by Reliance Jio. India's top telco's net profit fell 75% to 367 crore for the quarter ended on June 30.

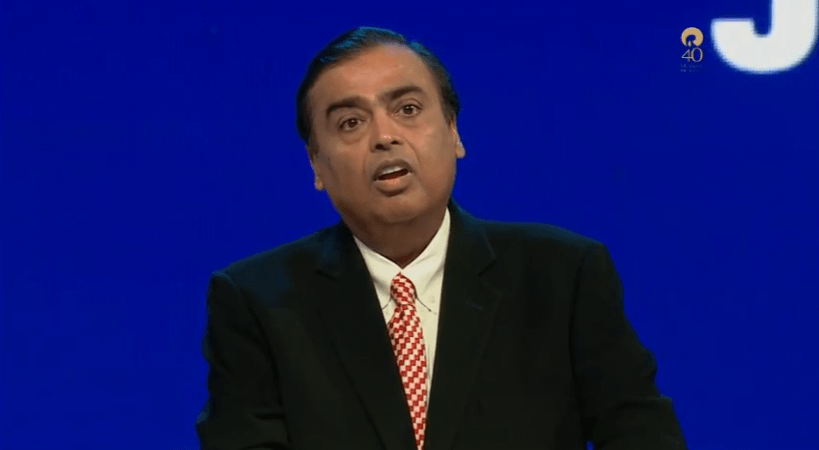

Reliance Industries Limited, led by Mukesh Ambani, has invested Rs. 200,000 crore into its telecom arm Reliance Jio. During the recent RIL AGM, the company said it has utilized the investment in the best possible way and the outcome has been nothing short of a miracle.

In a short span of six months since Reliance Jio was launched in the market, data consumption in India went from 20 crore GB to 120 crore GB per month and has been multiplying ever since. According to the company, Jio customers alone are consuming over 125 crore GB of data every month, including 165 crore hours of high-speed video, making Jio the largest mobile video network.

That's not it. Reliance Jio's entry has helped India get a global recognition. India was 155th in the world in mobile broadband penetration before Jio made its way to the market, but it now stands at number 1 in mobile data consumption and "well on its way to becoming number 1 in mobile broadband penetration, in the coming months," Ambani said during his recent AGM speech.

To recall, Airtel and Vodafone dominated the Indian telecom market and controlled the costs of 3G data. Not long ago, users would pay Rs. 250 for 1GB of 3G data for one month. It's all history now, as Jio has made 4G data as low as Rs. 10 per GB. Other telcos have been forced to follow the trend despite protesting Jio's motives.

Reliance Jio's investments and efforts will start paying off handsomely in the years to come. According to a survey conducted by the Boston Consulting Group (BCG), India is said to have more than 850 million online users by 2025 and Reliance Jio will trigger the majority growth in the country, IANS reported.

"While it took the country eight years to reach 250 million 3G connections, Reliance Jio 4G network added 100 million connections in just seven months," according to the BCG survey.

BCG also predicts that half of the entire internet user base in the country will be in rural areas, 40 percent of whom will be women and 33 percent will be 35 years or older. We don't see that as a surprise since the recent launch of JioPhone is aimed to connect 50 crore feature phone users in the country.

With the significant growth of internet users in India, the digital spending is also expected to increase by more than 10 times the current rate. India's digitally-influenced spending is at 45 billion-$50 billion (roughly Rs. 2,88,528 crores - Rs. 3,20,586 crores) a year and BCG suggests it can go as high as $500 billion - $550 billion (roughly Rs. 32,058,51 crores - Rs. 35,26,436 crores).