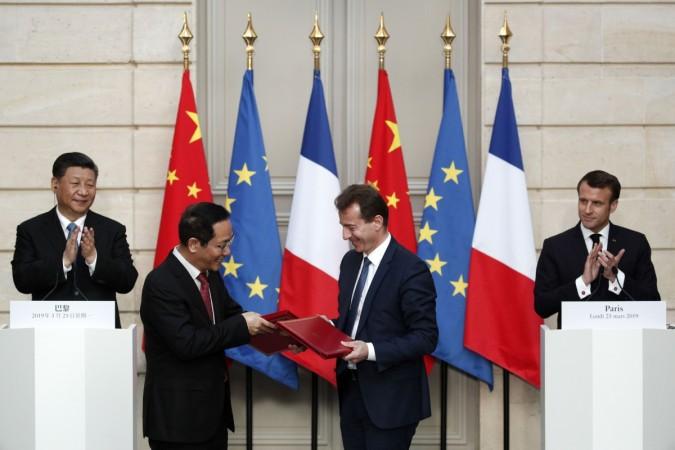

Airbus signed a deal worth tens of billions of dollars on Monday to sell 300 aircraft to China, coinciding with a visit to Europe by Chinese President Xi Jinping and matching a China record held by US rival Boeing.

The deal between Airbus and China's state buying agency, China Aviation Supplies Holding Company, which regularly coordinates headline-grabbing deals during diplomatic visits, will include 290 A320-family jets and 10 A350 wide-body jets.

French officials said the deal was worth some 30 billion euros at catalogue prices. Planemakers usually grant significant discounts.

The larger-than-expected order, which matches an order for 300 Boeing planes when US Donald Trump visited Beijing in 2017, follows a year-long vacuum of purchases in which China failed to place significant orders amid global trade tensions.

It also comes as the grounding of the Boeing 737 MAX has left uncertainty over Boeing's immediate hopes for a major jet order as the result of any warming of US-China trade ties.

There was no evidence of any direct connection between the Airbus deal and Sino-US tensions or Boeing fleet problems, but China watchers say Beijing has a history of sending diplomatic signals or playing off suppliers through state aircraft deals.

"The conclusion of a big (aviation) contract ... is an important step forward and an excellent signal in the current context," French President Emmanuel Macron said in a joint address with his Chinese counterpart Xi Jinping.

The United States and China are edging towards a possible deal to ease a months-long tariff row and a deal involving as many as 200 to 300 Boeing jets had until recently been expected as part of the possible rapprochement.

LONG-TERM RELATIONSHIP

China was also the first to ground the newest version of Boeing's workhorse 737 model earlier this month following a deadly Ethiopian Airlines crash, touching off a series of regulatory actions worldwide.

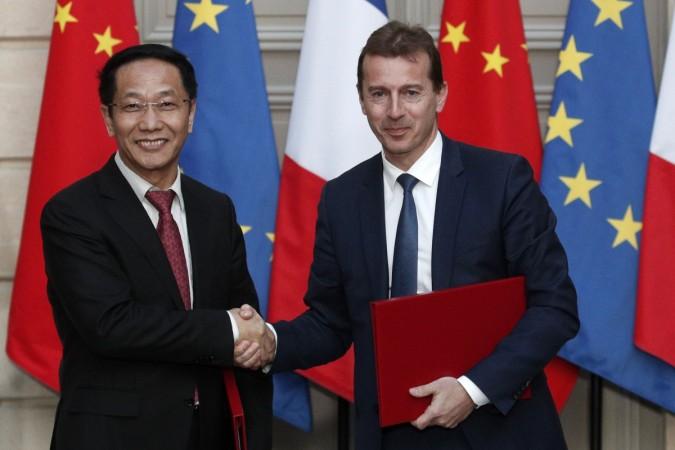

Asked if negotiations had accelerated as a result of the Boeing grounding or other issues, Airbus planemaking chief and designated chief executive Guillaume Faury told reporters, "This is a long-term relationship with our Chinese partners that evolves over time; it is a strong sign of confidence."

China has become a key hunting ground for Airbus and its leading rival Boeing, thanks to surging travel demand.

But whether Airbus or Boeing is involved, analysts say diplomatic deals frequently contain a mixture of new demand, repeats of older orders and credits against future deals, meaning the immediate impact is not always clear.

One industry source said the latest Airbus order included Chinese government confirmation of an unspecified number of orders already counted on Airbus' books but with the names of customers undisclosed. Airbus could not be reached for comment.

The outlook has also been complicated by Beijing's desire to grow its own industrial champions and, more recently for Boeing, the US-China trade war.

French President Macron unexpectedly failed to clinch an Airbus order for 184 planes during a trip to China in early 2018 and the two sides have been working to salvage it.

Industry sources have said the year's delay in Airbus negotiations, as well as a buying freeze during the US tariff row, created latent demand for jets to feed China's growth.