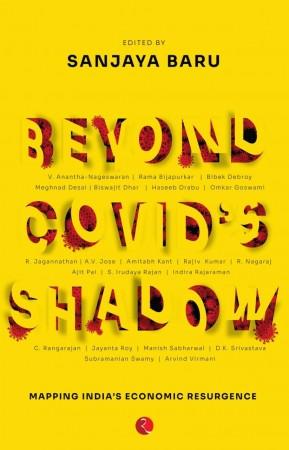

India's revival in a post-pandemic world is not just about getting the economic policy right, but also about getting governance and national priorities right, political commentator and policy analyst Sanjaya Baru writes in "Beyond Coronaviruss Shadow - Mapping India's Economic Resurgence".

A compendium of 20 scholarly essays by eminent economists, academicians and writers that Baru has also edited also includes a 12-point roadmap enunciated by Arvind Virmani, who has served as the government's Chief Economic Advisor and as India's Representative to the IMF.

"The defining reality of the post-COVID world is uncertainty about the behaviour of consumers, savers, investors, workers and entrepreneurs. Their confidence in the future has been shaken and shaped by a new kind of uncertainty that one normally associates with an all-out global war," Baru writes in his essay titled "The Political Economy of Uncertainty".

"Never after World War II has the entire world economy been exposed to uncertainty about the response of economic agents to policy signals. The novel coronavirus is indeed a novel experience for economic policymakers," he writes.

Bringing the economy back to its medium-term trajectory of growth requires imaginative policymaking and rebuilding confidence in the narrative of India's growth story, he says. "It is not just about getting the economic policy right, but also about getting governance and national priorities right," he notes.

The book, published by Rupa, has been divided into six parts: Managing Growth And Uncertainty, The Fiscal Dimension, Pandemic And The People, Trade Policy, Employment and Migration, and New Economy.

Setting the tone for future

Setting the tone for the discourse, Baru notes in the Introduction that economic policymaking "is, at the best of times, an exercise based on a variety of assumptions about human response to economic incentives and disincentives. Much theorizing and policy formulation have been based on the classic assumption of ceteris paribus (other things equal), but the pandemic has underscored the fact that 'other things are not equal'".

While the government has tried to stimulate both demand and supply through various policy measures, "the overall outlook for the economy has not been robust, with the 'animal spirits of private enterprise' considerably dampened. The new uncertainties injected by the pandemic into the minds of consumers, investors, salaried employees, workers and every segment of society have only made the situation worse, calling for a more concerted policy response".

"The lockdown has succeeded in accentuating the slowdown, with negative growth in the fiscal year 2020-21 likely to be followed by years of gradual recovery. Opinion is divided among analysts on the shape of the recovery curve - V, U, L, W or K- and the pace of recovery," Baru writes.

Virmani, in his essay titled "Policy Options For Post-Covid Growth, defines post-pandemic economic normalisation as attaining a level for major economic indicators such as GDP, IIP, UR% (unemployment rate percentage) equal to that prevailing in the corresponding period a year ago and suggests a 12-point action to achieve this:

1. Reform textiles import duties by replacing all specific duties with a uniform ad valorem tariff.

2. Integrate all GST rates on different textile ra w materials, fibres, fabrics and garments into a single rate, which, in a broader GST simplification, should be 15 per cent. The diversity of rates on cotton and manmade/artificial fibres/fabrics has left us out of global textile supply chains and progressively lowered our ranking in textile and ready-made garment exports.

3. Reduce GST on commercial vehicles, consumer durables and capital goods, currently at 28 per cent, to 25 per cent, and those at 18 per cent, to 15 per cent.

4. Integrate all subsides into a DBT/DCT system. To ensure ease of living, DCTs should be delivered directly to all rural residents and migrants on their mobile phones, with the husband and wife (one or both of whom could be migrants), receiving their share separately and the share of minor children delivered to the mothers' cell phones. This will ensure that the bottom 40 per cent can be financially protected from any future disasters.

5. To promote the acquisition of skills to move labour from casual to regular work, amend the Apprenticeship Act to make it easy to impart practical job skills, without being subject to inflexible labour laws.

6. Previously planned infrastructure and housing projects must be revived and accelerated.

7. A 'strategic industry policy' should be formally approved and implemented through privatization, equity and land sale as per policy.

8. The three acts proposing simplification of labour laws are now before Parliament and should be passed after deleting clauses that reduce flexibility. While the fourth labour law is being formulated, the special economic zone (SEZ) law should be revised to introduce flexibility in retrenching workers made redundant by demand fluctuations.

9. Ease of doing business can be enhanced by reducing the number of regulations, eliminating criminal penalties and facilitating digital filling/filing of simplified forms followed by randomized post audits to ensure implementation of critical regulations relating to health, safety and environment. This can be included in the SEZ law amendment while the general simplification is devised.

10. Import substitution policy should be strictly restricted to the few countries that are known to have used asymmetric trade, FDI and technology policies, while a freer trade approach is adopted for all other countries. The supply chain resilience initiative, product-linked incentives and consumer goods tariffs should be on goods exported by such countries.

11. Reduce the differential, higher electricity price for industry as proposed in the amendment to the Electricity Act (2003). Set up common treatment centres for chemical plants to attract supply chains.

12. Rationalize and simplify GST by choosing one of the two options proposed with new rates effective from 1 April 2021. Rationalize and simplify the Direct Tax Code as per the 255-page law proposed in August 2009. These tax reforms are essential for Atmanirbhar as they will level the playing field for small and medium enterprises to compete with companies (given the excellent corporate tax reform of 2019).

"I am an optimist; in my view a growth take-off is possible in FY22 if we complete all pending reforms by March-end 2021," Virmani writes.

Among the other takeaways from the book:

Bibek Debroy: The series of economic reforms introduced by the government, even before COVID struck, will hold the economy in good stead as it recovers from the impact of the pandemic and the lockdown.

C. Rangarajan and D.K. Srivastava: Policy reforms are essential to overcome both the immediate challenges facing the economy as well as the underlying structural and cyclical factors that have impacted the growth momentum.

Rajiv Kumar and Ajit Pai: Increase investment to create efficient infrastructure, improve logistics and provide energy and capital inputs at globally comparable rates to the domestic industry, so as to improve its global competitiveness.

Amitabh Kant: The initiatives being undertaken as part of the Atmanirbhar Bharat initiative will restore the economy's growth momentum.

Subramanian Swamy: The Modi government's leadership on the economic policy front is random, unstructured and devoid of clarity on economic priorities. With no objectives set, the policy lacks a clear strategy, both for mobilizing the required resources and utilizing them in an optimal manner.

Two principles must guide policy: (a) incentives, rather than coercion, should be deployed to shape individual behaviour, and the government should make no promise to the people without specifying the sacrifice required to be made by them to make it happen; (b) it should be the aim of policy to make India a globally competitive economy with assured access to the markets and technological innovations of the US and some of its allies, such as Israel.

Haseeb Drabu: The government's policy response across many fronts has raised questions about its commitment to the constitutional principles of fiscal federalism. 'Lateral federalism' should replace the current practice of 'vertical federalism' as excessive policy centralization not only goes against the grain of fiscal federalism but imposes economic costs.

Meghnad Desai: Build on some of Kerala's initiatives in responding to the public health challenge by strengthening safety nets and building 'storm shelters'; build a strong foundation for a 'welfare state'.

Jayanta Roy: Remain open to international trade flows, reversing the recent slide into defensive protectionism; sign or widening trade deals with the US, European Union (EU), Japan, South Korea and the Association of Southeast Asian Nations (ASEAN), while finding ways to deal with technical barriers to trade.

V. Anantha-Nageswaran: There is a possibility that global economic instability as a consequence of the pandemic could trigger 'the end of the US dollar's reign' as the principal global reserve currency.

This is perhaps the first comprehensive attempt to accommodate diverse opinions in dealing with a post-pandemic world. To that extent, it's of immense value to the narrative on the road ahead.