Vivo, the young Chinese smartphone company that raised several eyebrows by becoming the world's fifth-largest mobile phone maker in the second quarter of 2017, is on the lookout for more profits outside its home turf.

Riding high on the success against giants like Apple and Samsung in the Chinese market, this Dongguan-based smartphone upstart is now planning to take on pricier devices of bigger rivals with its relatively low-priced models in the western markets.

Vivo, currently China's third-largest smartphone brand after Huawei and Oppo, launched its new X20 smartphone in Hong Kong on Friday, and also announced its global expansion plan in overseas markets, including Singapore, Taiwan, Russia and Africa.

"Since our first entry into the international markets in 2014, we have dedicated [ourselves] to understanding the needs of consumers through in-depth research to bring innovative and stylish products that meet their lifestyle and needs," Vivo's senior vice-president Alex Feng said in a statement.

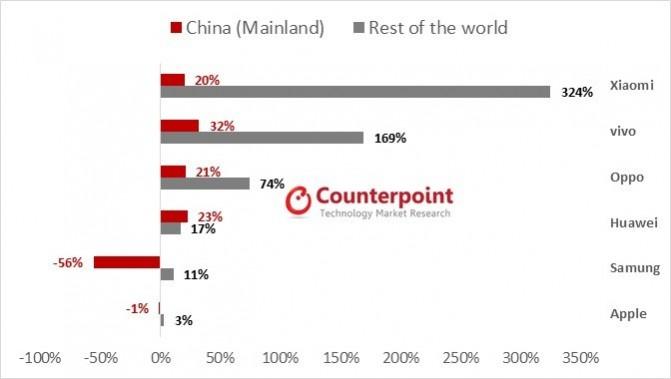

Founded in 2009, Vivo, along with Oppo, edged out the then-leader Xiaomi from the top three brands on the mainland. Even in the worldwide market, Xiaomi is now ranked sixth after Huawei, Oppo and Vivo while Samsung and Apple continue to be at the top two spots, according to Counterpoint Research.

The strategy, which worked for both Vivo and Oppo was to put more effort on offline sales instead of depending on e-commerce. Handsets with high-end features, but sold at a fraction of those from the likes of Apple and Samsung, also contributed immensely to their overall growth.

Vivo's plan to branch out abroad also comes at a time when smartphone sales in China grew by a modest three percent in the April-June quarter. However, experts still believe that Chinese market showed a positive uptick in demand as well as supply during the three-month period.

Vivo already has a strong presence in Asian countries, including Indonesia, Thailand, Philippines, Vietnam, India, Nepal and Pakistan. The company is currently the third-most popular brand in India, with a 9.5 percent share of the market.