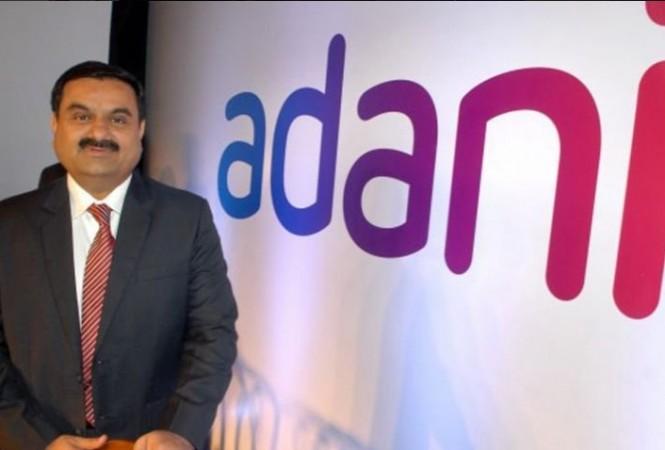

Gautam Adani led Adani group may become the new entrant to join the race to buy debt-laden national carrier Air India. The company is expected to submit an expression of interest (EoI) by next month. However, the final decision will be taken after a detailed analysis after the submission of the EoI. As per norms, a prospective bidder gets the access to the data of the airline after the EoI process.

Notably, besides Adani group other companies including the Tata group, the Hinduja group, Indigo and a New York-based fund, Interups are expected to submit EoIs next month to buy the 'Maharajah'.

The Adani group is executing its ambitious plan to become India's largest private airport operator with three airports already in its belt including Lucknow, Ahmedabad, and Mangalore. Moreover, it has already won the bids for operating three more airports - Thiruvananthapuram, Ahmedabad, and Guwahati although the government clearance is awaited.

Long pending plan to Disinvest Air India

Presently, Air India is reeling under a huge debt of Rs 58,000 crore. The central government has been looking to disinvest Air India for a while now. In March 2018, the government had issued preliminary information memorandum kicking off Air India's disinvestment process. After not receiving any bids, the government was eventually forced to defer the strategic plan to sell its 76 percent stake in the airline. The offer still did not receive any bid and finally the government decided to sell 100 percent of the airline's stake instead of 76 percent offered in the first round. In this years' budget speech, finance minister Nirmala Sitharaman mentioned Air Indian as one of the state-owned companies to be disinvested this fiscal year.

Adani group may face legal hurdle

As per a report in financial daily Business Standard, the Adani group may face legal challenges given its ownership of airports. Although there is no cap on an airport developer to bid for Air India, the bid condition for six Airport Authority of India (AAI) airports won by the Adani group place ownership restrictions. As per the rules, an airline or a group owning an airline cannot have ownership of more than 27 percent in these six airports.