Nearly 27 lakh UPI domestic payment fraud cases involving a whopping amount of Rs 2145 crore were reported in the country during the last three years.

In a written reply in the Lok Sabha, the Minister for State in the Ministry of Finance Pankaj Choudhary said that the Reserve Bank of India (RBI) has implemented the Central Payment Fraud Information Registry (CPFIR), a web-based payment-related fraud reporting tool since march 2020.

All the Regulated Entities (RE) are required to report the payment-related frauds to the said CPFIR.

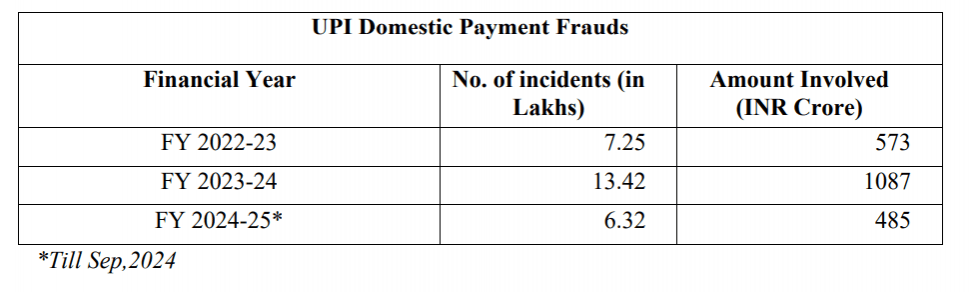

The Minister informed that in the financial year 2022-23, 7.25 lakh UPI domestic payment fraud cases involving Rs 5.73 crore were reported. The number of fraud cases increased to 13.42 lakh in the financial year 2023-24 involving an amount of Rs 1087 crore.

In the current financial year, 6.32 lakh fraud cases have been reported so far in which cheaters have cheated Rs 485 crore from innocent customers.

Steps taken to prevent fraud

The Minister said that in order to prevent payment-related frauds including UPI transaction frauds, various initiatives have been taken by the Government, RBI and National Payments Corporation of India (NPCI) from time to time.

These, inter alia, include device binding between the customer's mobile number and the device, two-factor authentication through PIN, daily transaction limit, limits and curbs on use cases, etc.

Further, NPCI provides a fraud monitoring solution to all the banks to enable them to alert and decline transactions for fraud mitigation by using AI/ML-based models.

RBI and Banks have also been taking awareness campaigns through short SMS, radio campaigns, publicity on prevention of 'cyber-crime' etc.

In order to facilitate the citizens to report any cyber incidents including financial frauds, the Ministry of Home Affairs (MHA) has launched a National Cybercrime Reporting Portal (www.cybercrime.gov.in) as well as a National Cybercrime Helpline Number "1930".

Further, customers can also report financial fraud on the official customer care website or banks' branches.

DoT launches dedicated digital platform to check fraud

The Minister further informed that the Department of Telecommunications has launched the Digital Intelligence Platform (DIP) and 'Chakshu' facility on the Sanchar Saathi portal (https://sancharsaathi.gov.in).

'Chakshu' facilitates citizens to report suspected fraud communication received over call, SMS or WhatsApp with the intention of defrauding like KYC expiry or update of bank account / etc.

RBI's Payments Vision Document 2025 has outlined expanding the global outreach of UPI and RuPay cards as one of the key objectives under the 'internationalization' pillar.

In this regard, RBI is currently collaborating with various relevant stakeholders to expand the outreach of UPI through the following modes

- Interlinking of UPI with Fast Payment System (FPS) of other countries for personal remittances on a reciprocal basis.

- Acceptance of UPI Apps via QR codes at merchant locations abroad and vice-versa.

- Deployment of UPI-like infrastructure in other countries.