The year 2014 has been bumpy for the U.S. housing market. After a slow start in the beginning of the year, the market picked up pace in the summer and fall, marking steady growth. Will that spill over into the New Year?

Realtor.com recently released a 2015 outlook for the American housing market asserting that the year will be profitable for first-time home buyers, as the economy recovers steadily.

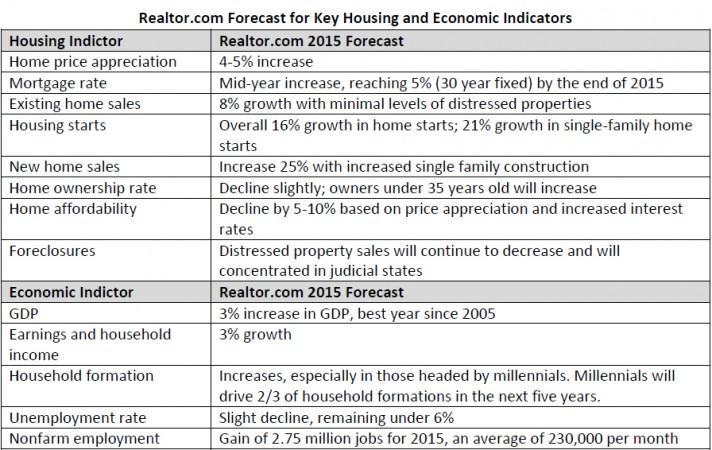

Highlights from the outlook:

1. Millennials – the New Heroes

Millennials will have a major hand at shaping the housing market in 2015. More than two-thirds of the household formation will be driven by this demographic group. Also, with the economic recovery in full swing and a projected addition of 2.5 million jobs next year, more people in the 18 to 35-year-old age bracket can aim for homeownership.

2. Improving Existing Home Sales

Existing home sales are expected to improve 8 percent over the year 2015. This sector will also benefit from the recovery. As more people get employed and incomes increase, distressed property inventory is expected to fall. With more buyers entering the market, the stock of existing homes will be lapped up quickly.

3. Home Prices will Increase

As demand for homes goes up, prices are also expected to rise. This year, the rate of price increases has been slow, but with a rush of new buyers entering the market, home prices are expected to go up by an average of at least 4.5 percent in the coming year.

4. Mortgage Rates to Shoot up too

Mortgage rates across the United states have been hovering near or below 4 percent throughout 2014. This week, the average 30-year-fixed-rate fell to 3.89 percent, lowest since May 30, 2013. But with all the other parameters improving and the Federal reserve's rate hike expected in the initial few months, home loan rates will reportedly shoot up to 5 percent next year.

5. Home Affordability to Decline

Home affordability is expected to decline by 5 to 10 percent as prices appreciate and mortgage rates go higher. Tighter supply will boost demand, which will also result in a spike in prices, affecting affordability.

"In 2015, more markets will settle back into their long-term housing patterns. Fast-growing markets that boomed last decade, collapsed in the bust, and then rebounded are now leveling off. Even the markets that have been slowest to recover and have struggled longest are seeing foreclosure inventories decline and the sales mix moving back toward normal," Jed Kolko, chief economist at Trulia told US News.